Yield to maturity in Stata

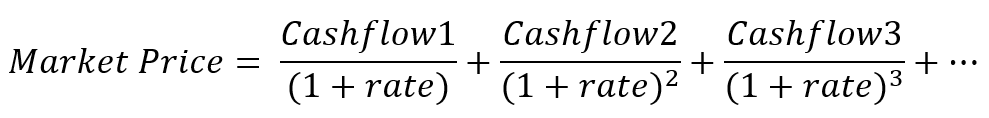

The approximate yield to maturity for a coupon bond can be found using the following formula.

However, the above formula does not provide the exact value of YTM.

There are several tools in Stata that can be used to solve for the rate in an iterative process, including the suite of optimizer() functions in the Mata language, the group of

Our Codes

Our codes use the

These codes are available with two options. If you need the codes as is, the price is $100. The second option has a price of $150, where we adjust the code according to your data and variable names so that the application of the codes is smooth.

Customization of the code

The codes can be further customized as per a given research design. For further details and pricing, please contact us at

attaullah.shah@imsciences.edu.pk