Implied cost of equity (ICC) GLS model

Implied cost of equity (ICC) GLS model

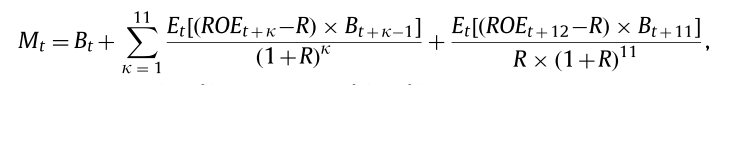

The ICC model proposed by Gebhardt, Lee, and Swaminathan (2001), commonly known as the GLS model, is considered the most challenging model in terms of coding and practical implementation. This model predicts various parameters, including earnings and the book value of equity, up to 12 periods in advance. Subsequently, it calculates the implied cost-of-capital (equity) for each firm by determining the internal rate of return that equalizes the present value of expected future cash flows with the current stock price. The model is presented below:

Our Stata Code

Our Stata Code

We have developed user-friendly yet robust code for estimating the implied cost of equity using the GLS model. Additionally, we have included comments on each line of code to assist you in both applying the code and comprehending the process more effectively. It is worth noting that there are several Mata-based codes freely available on the Statalist. However, these codes often contain errors and tend to generate significantly low ICC rates due to incorrect linear interpolation and model parameter forecasting. In contrast, our code yields results that are highly similar to those reported in the GLS paper.

Furthermore, we offer codes for other ICC models, such as Claus and Thomas (2001), Ohlson and Juettner-Nauroth (2005), Easton (2004), and Gordon and Gordon (1997) [see detail here ] . Besides ICC models, we have codes for finding cost of equity using Fama and French model of CAPM [ see details here ]

How to get the code?

How to get the code?

Once you have made the payment, please send the payment reference to the following email address. We shall send the code within 24 hours via return email, along with some example datasets.

![]()

attaullah.shah@imsciences.edu.pk

Stata.Professor@gmail.com

Pay with PayPal / Credit Card

Pay with PayPal / Credit Card

OFF on the Full Package

OFF on the Full Package

Get the Complete Set of 5 ICC Models for Only £349!

Seize this exceptional opportunity with a remarkable 43% discount on our Implied Cost of Capital (ICC) models. For a limited period, gain access to all of the five ICC models, extensively used in research for their robustness, at an unbeatable price of just £349, down from the original £615.

References:

Gebhardt, W., Lee, C.M., Swaminathan, B., 2001. Toward an implied cost of capital. Journal of Accounting Research 39, 135–176.

page tags

Calculate implied cost of equity capital using Gebhardt et al. (2001) model