This is a quick overview of how to use asreg command for running regressions by groups. To know about the installation and other details of asreg, please click here.

Regressions by groups in Stata

A group is a subset of data that has a common identifier. Examples of groups can include families, industries, countries, regions, months, years, portfolios, etc. If a linear regression needs to be estimated separately for each group, asreg is the best option. asreg is blinking fast and writes all regression outputs to the data in memory as separate variables. This eliminates the need for writing the results to a separate file which is usually then merged back to the data for any further calculations. asreg eliminates all these steps and provides convenient and clean solution to by-group regression and rolling regressions. IF not installed, asreg can be installed from ssc with this line of code:

ssc install asreg

An Example

We shall use the grunfeld data set in our example. Let’s download it first:

webuse grunfeldbysort year: asreg invest mvalue kstockbys company: asreg invest mvalue kstock

* List the estimated cofficients

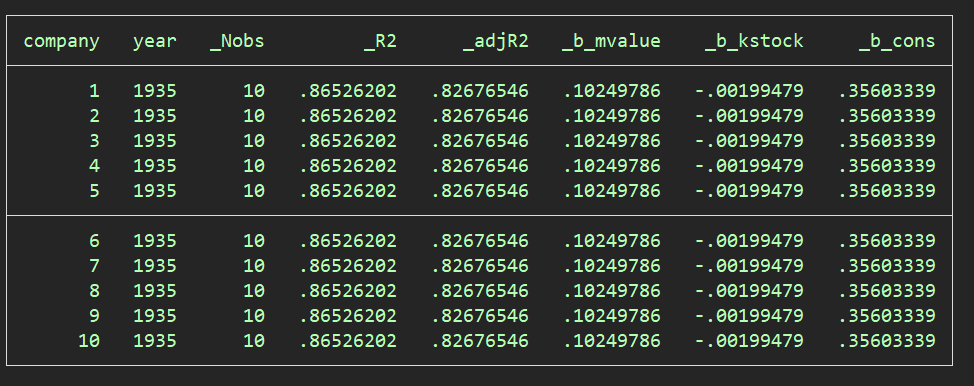

sort year company

list company year _Nobs _R2 _adjR2 _b_mvalue _b_kstock _b_cons in 1/10

Standard errors and fitted values

If standard errors are needed for each explanatory variable, we shall just add the otpion se. Similarly, we can add option fit if fitted values are required.

bys company: asreg invest mvalue kstock se

bys company: asreg invest mvalue kstock se fit

How can I run a regression by groups of firms and include lagged variables in the model?

To include lagged variables, you would first generate a lagged_variables and then supply it as an argument to the asreg command. For example, the following code generates the lagged variable L_mvlaue, declares the data panel data, and runs a regression of invest on mvalue, kstock, and the lagged value of mvalue for each company.